Bond market diagram

Home » Background » Bond market diagramYour Bond market diagram images are ready. Bond market diagram are a topic that is being searched for and liked by netizens now. You can Find and Download the Bond market diagram files here. Find and Download all free photos.

If you’re looking for bond market diagram images information linked to the bond market diagram interest, you have come to the ideal site. Our website frequently provides you with hints for seeing the highest quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

Bond Market Diagram. The nominal interest rate found on the money market graph as well as the real interest rate found on the loanable funds market graph impact the price of bonds. The creation of a liquid government bond market providing basic investment and. The face value of the bond. Higher currency demand causes inflation which is the reduction of a currencys purchasing power.

Us Home Prices Chart Adjusted For Inflation 1890 2013 House Prices Price Chart Price From pinterest.com

Us Home Prices Chart Adjusted For Inflation 1890 2013 House Prices Price Chart Price From pinterest.com

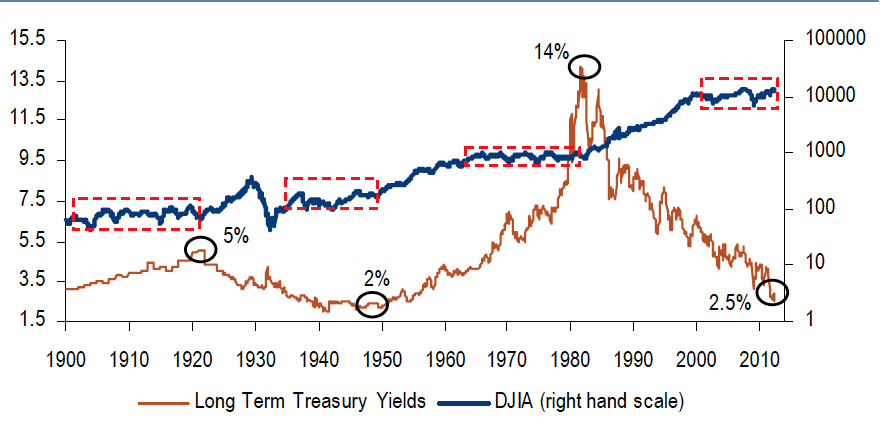

Bond prices and bond yields are excellent indicators of the economy as a whole and of inflation in particular. Also the market value of a bond will always approach its par value as maturity is approached. Shift in patterns for emerging market borrowers towards bond financing resulting in a contraction in syndicated lending business. Using the line drawing tool show the effect on bond supply. If the bank buys or purchases the bonds from the market on the one hand the stock of money will increase and. Markets and market participants are intermingled in todays environment trading is a.

Using the line drawing tool show the effect on bond demand.

Expansionary Monetary Policy and Its Effects With Diagram Expansionary Monetary Policy and Its Effect on Interest Rate and Income Level. Using the diagram to the right representative of a primary bond market show the effects of an increase in household wealth and an increase in expected profitability of investments. Markets and market participants are intermingled in todays environment trading is a. You can use a financial calculator or an online Yield to Maturity YTM Calculator to calculate your results. Suppose that the market price of a bond is 950 and the face value is 1000. It shows combinations of interest rates and levels of output such that planned desired spending expenditure equals income.

Source: pinterest.com

Source: pinterest.com

The bond price falls below its par value and called apremium bond if other-wise. In this section we will explore the link between money markets bond markets and interest rates. The demand curve for money is derived like any other demand curve by examining the relationship between the price of money which we will see is the interest rate and the quantity demanded holding all other determinants unchanged. Term structure of interest rates The interest rate market is where the price of rising capital is set. To understand why take an example of a bond that originally sold for.

Source: pinterest.com

Source: pinterest.com

Term structure of interest rates The interest rate market is where the price of rising capital is set. If the bank buys or purchases the bonds from the market on the one hand the stock of money will increase and. 2 ASEAN3 Bond Market Guide. A video covering Bonds and Bond YieldsInstagram econplusdalTwitter. The goods- market equilibrium schedule is a simple extension of income determination with a 45 line diagram.

Source: pinterest.com

Source: pinterest.com

In this section we will explore the link between money markets bond markets and interest rates. Bond prices and bond yields are excellent indicators of the economy as a whole and of inflation in particular. Interest rates and bond prices are inversely related so as interest rates rise bond prices fall and vise versa. Shift in patterns for emerging market borrowers towards bond financing resulting in a contraction in syndicated lending business. The goods market equilibrium schedule is the IS curve schedule.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bond market diagram by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.