Bull call spread payoff diagram

Home » Wallpapers » Bull call spread payoff diagramYour Bull call spread payoff diagram images are ready in this website. Bull call spread payoff diagram are a topic that is being searched for and liked by netizens today. You can Download the Bull call spread payoff diagram files here. Download all free vectors.

If you’re searching for bull call spread payoff diagram images information linked to the bull call spread payoff diagram keyword, you have come to the right site. Our website frequently provides you with hints for seeking the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

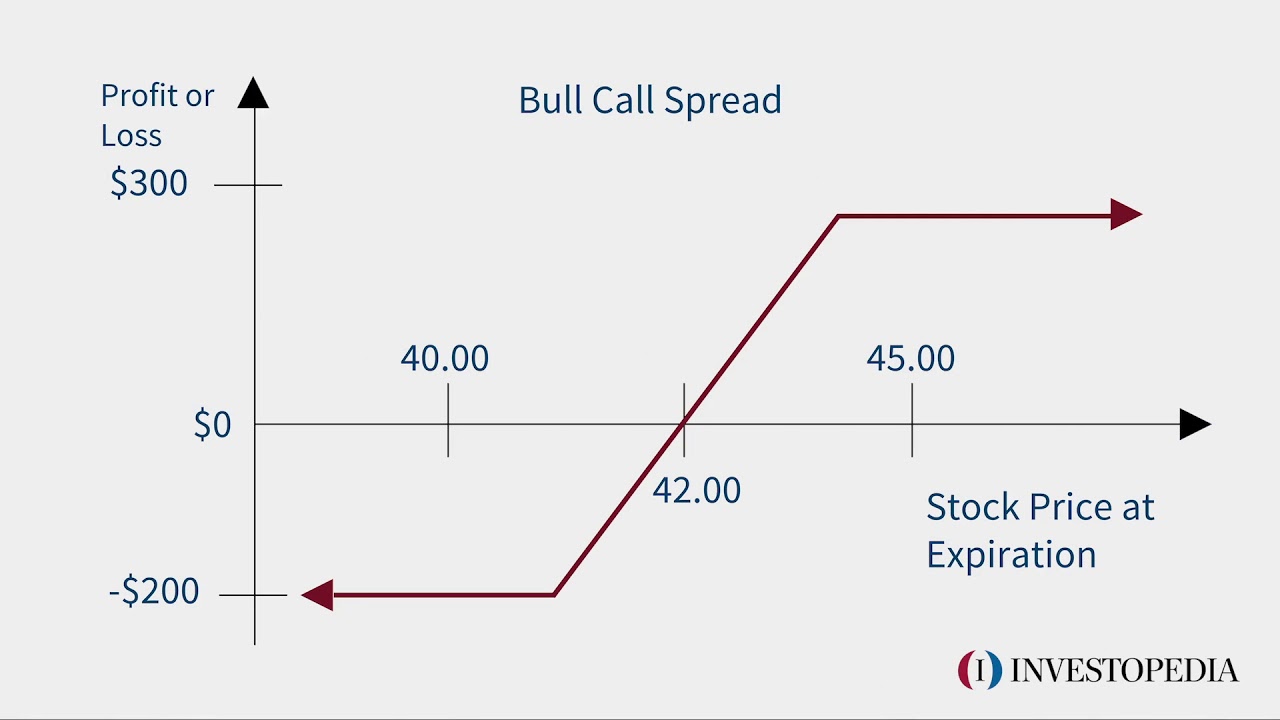

Bull Call Spread Payoff Diagram. Since this option strategy is based on the fact that the buying option is the predominant force the bull call spread inherits some of the buying options disadvantages such as the negative effects of time decay. Long Call Strike and the Short Call Strike. X axis shows underlying price Y axis profit or loss. The green line is the long 45 strike call.

Basic Spreads Options Trading Strategies Option Strategies Trading Courses From pinterest.com

Basic Spreads Options Trading Strategies Option Strategies Trading Courses From pinterest.com

Trading Example The Bull Call Spread is one of simple options spread trading strategy which can be constructed simply by taking 2 positions. Maximum loss 8. Payoff Schedule and diagram at the expiration date. The red line is the short 50 call. Bull call spreads require a debit when entered. Only difference is that in bull put spread there is an inflow of premium.

Since this option strategy is based on the fact that the buying option is the predominant force the bull call spread inherits some of the buying options disadvantages such as the negative effects of time decay.

Bull call debit spread payoff diagram In the bull call spread strategy we will make a profit as the underlying prices increase in value while generating a loss as they fall. Impact of stock price change A bull call spread rises in price as the stock price rises and declines as the stock price falls. Details about Bull Call Spread Payoff Function Chart explained with an example As mentioned in our previous article Bull Call Spread. The below bull call spread option payoff is from Interactive Brokers. Payoff Schedule and diagram at the expiration date. Bull put spread payoff diagram The following step is to learn the profit and loss we can expect in this bull put spread example.

Source: nl.pinterest.com

Source: nl.pinterest.com

1 Buy or Long an In the Money ITM Call Option and. Bear Call Spread Payoff Diagram Calendar Spread An options or futures spread established by simultaneously entering a long and short position on the same underlying asset at the same strike price but with different delivery months. 1 Buy or Long an In the Money ITM Call Option and. Bull Call Spread Payoff Diagram. Payoff schedule for bull call put spread is the same.

Source: pinterest.com

Source: pinterest.com

Call broken-wing butterflies are still a bull call spread and. Bull Call Spread Payoff Diagram. Bull Put Spread Payoff Diagram. Call broken-wing butterflies are still a bull call spread and. The bull call spread payoff diagram clearly outlines the defined risk and reward of debit spreads.

Source: pinterest.com

Source: pinterest.com

Benefits and Drawbacks of Using a Bull Call Spread. Maximum loss 8. The breakeven price at expiration is 11650 long strike price plus the premium paid. Long Call Strike and the Short Call Strike. The bull call spread option was an AAPL 115120 strike call bought at 150 per contract or 150 in total.

Source: pinterest.com

Source: pinterest.com

Bull Spread Payofi Diagram Based on Chapter 1 of Des Highams Introduction to Financial Option Valuation November 29 2007 In this flrst lab session we will use Matlabs plotting facilities to explore payofi diagrams for the bull spread of European call options. Bull Put Spread Payoff Diagram. Maximum loss 8. Applying the formulas for a bull call spread Jorge determines the. 000 Commissions Option Trading.

Source: nl.pinterest.com

Source: nl.pinterest.com

Payoff diagram of bull call spread Below is the payoff diagram of a Bull call spread. A payoff graph will show the option positions total profit or loss Y-axis depending on the underlying price x-axis. The bull call spread payoff diagram clearly outlines the defined risk and reward of debit spreads. Bull Call Spread Max Profit Difference between call option strike price sold and call option strike price purchased Premium Paid for a bull call spread. Bull Call Spread Option Payoff Graph Understanding payoff graphs or diagrams as they are sometimes referred is absolutely essential for option traders.

Source: pinterest.com

Source: pinterest.com

Long Call Strike and the Short Call Strike. Although we have shared the Bull Call Spread diagram above here are few other versions of it for your reference along with a quick summary. Bull call spread payoff diagram Bull Call Spread Option Payoff Graph - Options Trading I. The blue line shows overall bull put spread PL the green line is the higher strike short put and the red line is the lower strike long put. Bull Call Spread Max Profit Difference between call option strike price sold and call option strike price purchased Premium Paid for a bull call spread.

Source: pinterest.com

Source: pinterest.com

Bull call spread payoff diagram Bull Call Spread Option Payoff Graph - Options Trading I. The motivation of the strategy is to generate a profit if the stock rises but make the strategy cheaper than simply buying a call option. The breakeven price at expiration is 11650 long strike price plus the premium paid. Payoff Schedule and diagram at the expiration date. Call broken-wing butterflies are still a bull call spread and.

Source: pinterest.com

Source: pinterest.com

The primary benefit of using a bull call spread is that it costs lower than buying a call option. Bull Call Spread Option Payoff Graph Understanding payoff graphs or diagrams as they are sometimes referred is absolutely essential for option traders. Maximum profit 180 145 8 27. Payoff diagram of bull call spread Below is the payoff diagram of a Bull call spread. The debit paid is the maximum potential loss for the trade.

Source: pinterest.com

Source: pinterest.com

Get real-time quotes in Excel. Bull call spreads require a debit when entered. The payoff diagram of a long call butterfly defines the maximum risk and reward. To confirm Jorge creates a payout table. X axis shows underlying price Y axis profit or loss.

Source: pinterest.com

Source: pinterest.com

Bull Call Spread Payoff Diagram. In general with a bull put credit spread strategy we will make a profit as the underlying prices increase in value while we will be obtaining a. Between the higher strike price and the lower strike price profits grow as the long call increases while the short call is still out-of-the-money. The green line is the long 45 strike call. Bull Call Spread Payoff Diagram.

Source: pinterest.com

Source: pinterest.com

To illustrate the call option strike price sold is 5500 and the call option strike price purchased is 5250. A bull call spread is the strategy of choice when the forecast is for a gradual price rise to the strike price of the short call. Bull Call Spread Payoff Diagram. Trading Example The Bull Call Spread is one of simple options spread trading strategy which can be constructed simply by taking 2 positions. Impact of stock price change A bull call spread rises in price as the stock price rises and declines as the stock price falls.

Source: pinterest.com

Source: pinterest.com

The maximum loss on the trade is defined at entry by the combined cost of the four call options and is realized if the underlying stock price closes above or below the long options at expiration. To confirm Jorge creates a payout table. Bull put spread payoff diagram The following step is to learn the profit and loss we can expect in this bull put spread example. 1 Buy or Long an In the Money ITM Call Option and. Bull Call Spread Max Profit Difference between call option strike price sold and call option strike price purchased Premium Paid for a bull call spread.

Source: in.pinterest.com

Source: in.pinterest.com

Payoff diagram of bull call spread Below is the payoff diagram of a Bull call spread. Looking at the payoff diagram we can see that above the higher strike price both options are in-the-money and profit is both constant and positive due to the short call offsetting the long call. The breakeven price at expiration is 11650 long strike price plus the premium paid. The red line is the short 50 call. The payoff diagram of a long call butterfly defines the maximum risk and reward.

Source: pinterest.com

Source: pinterest.com

Because a short option is sold to reduce the trades cost basis the maximum profit potential is limited to the spread width minus the debit paid. The bull call spread option was an AAPL 115120 strike call bought at 150 per contract or 150 in total. Maximum profit 180 145 8 27. The red line is the short 50 call. Bull Call Spread Option Payoff Graph Understanding payoff graphs or diagrams as they are sometimes referred is absolutely essential for option traders.

Source: pinterest.com

Source: pinterest.com

The maximum loss on the trade is defined at entry by the combined cost of the four call options and is realized if the underlying stock price closes above or below the long options at expiration. Bull Call Spread Payoff Diagram. Details about Bull Call Spread Payoff Function Chart explained with an example As mentioned in our previous article Bull Call Spread. To confirm Jorge creates a payout table. Between the higher strike price and the lower strike price profits grow as the long call increases while the short call is still out-of-the-money.

Source: pinterest.com

Source: pinterest.com

Maximum profit 180 145 8 27. Bull Call Spread Option Payoff Graph Understanding payoff graphs or diagrams as they are sometimes referred is absolutely essential for option traders. Get real-time quotes in Excel. A key noticeable feature of this diagram is that maximum loss is limited as well as Maximum Profits are limited making this an excellent tool to go bullish on markets with defined risk. This is a representation of an expiration payoff graph and if you look at the above Bull Call Spread diagram closely you will find a couple of strike points ie.

Source: pinterest.com

Source: pinterest.com

The bull call spread option strategy is also known as the bull call debit spread as a debit is taken upon entering the trade. Bull put spread payoff diagram The following step is to learn the profit and loss we can expect in this bull put spread example. To illustrate the call option strike price sold is 5500 and the call option strike price purchased is 5250. Trade options FREE For 60 Days when you Open a New OptionsHouse Account. The breakeven price at expiration is 11650 long strike price plus the premium paid.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bull call spread payoff diagram by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.