Forward triangular merger diagram

Home » Wallpapers » Forward triangular merger diagramYour Forward triangular merger diagram images are ready. Forward triangular merger diagram are a topic that is being searched for and liked by netizens now. You can Get the Forward triangular merger diagram files here. Download all royalty-free photos and vectors.

If you’re looking for forward triangular merger diagram images information linked to the forward triangular merger diagram topic, you have pay a visit to the ideal site. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

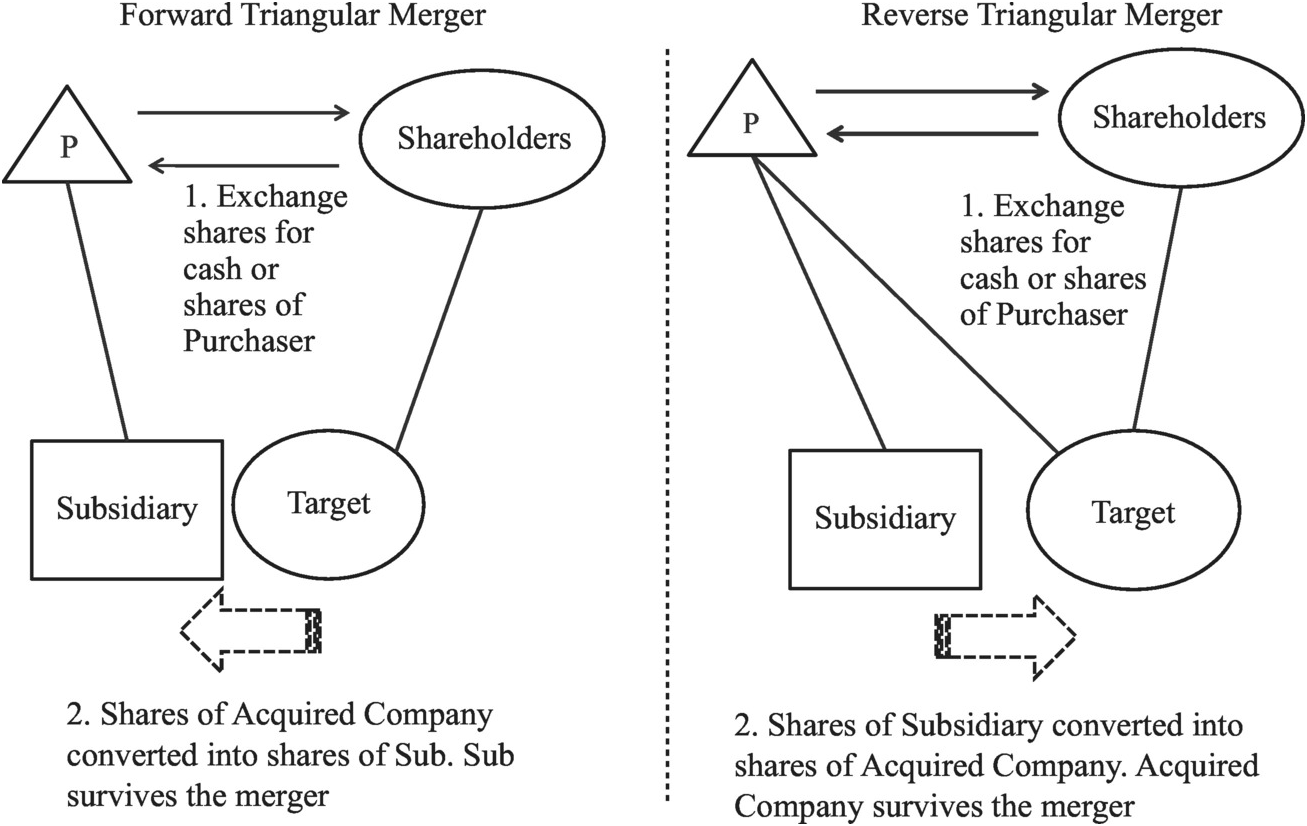

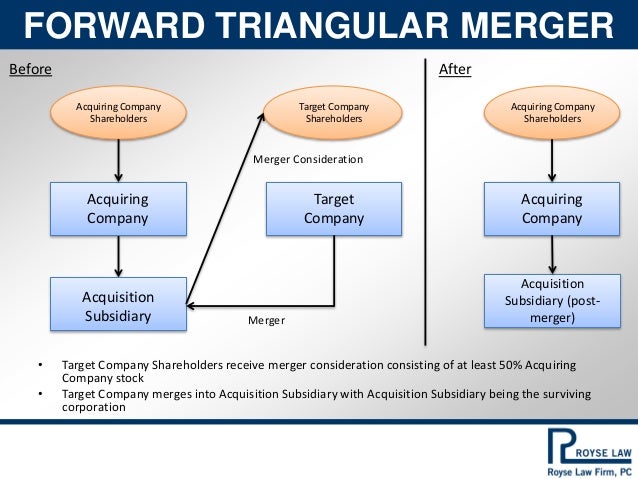

Forward Triangular Merger Diagram. Tax loss mergers are acquisitions where the Buyer pays the seller extra for the value of tax loss carry forward. Acquirings Sub stock is converted into Target stock and the former Target shareholders receive the merger consideration in exchange for their. MA Structure Diagram Triangular Forward Merger. Whereas Company S is usually a newly-formed shell company which is formed for the purposes of the merger by Company H.

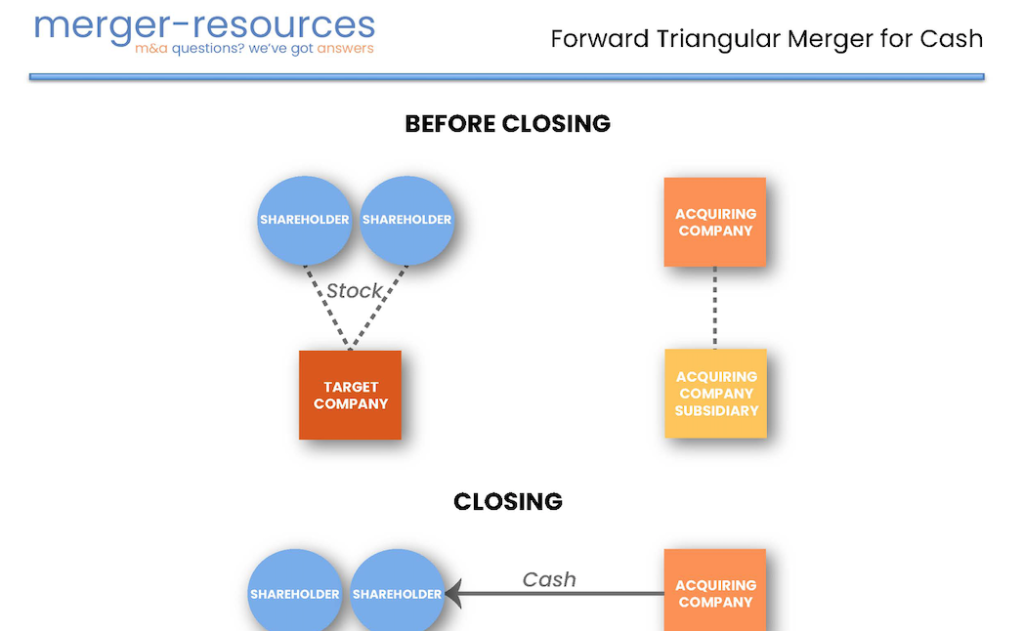

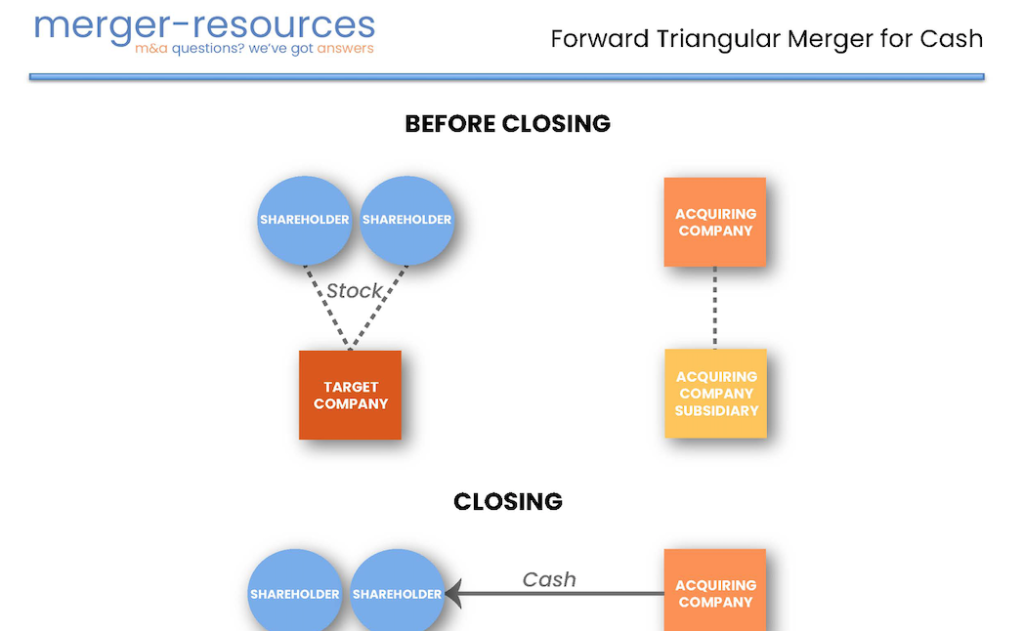

Image Merger Resources From merger-resources.com

Image Merger Resources From merger-resources.com

Home Template Tools MA Structure Diagram Triangular Forward Merger. This MA deal structure normally takes place when the merger combines both cash and stock. Survives as a subsidiary of the Acquiring Co. Merger Cash Stock or Other Stockholders Consideration of Target Target Subsidiary Buyer Buyer Subsidiary Combined with Target Former Target Stockholders Hold If Cash Deal Subsidiary is surviving corporation. See the graphic below. In an indirect merger the target company will merge with a subsidiary company of the buyer.

Must acquire substantially all of Targets assets 4.

Forward Triangular Merger. Type A Reorganization Forward Triangular Merger 1. See the graphic below. Basic Forms of Acquisition contd Reverse Triangular Merger 14. Merger Cash Stock or Other Stockholders Consideration of Target Target Subsidiary Buyer Buyer Subsidiary Combined with Target Former Target Stockholders Hold If Cash Deal Subsidiary is surviving corporation. A forward triangular merger involves the acquiring company forming a subsidiary company as described above.

Source: cambridge.org

Source: cambridge.org

Merger Cash Stock or Other Stockholders Consideration of Target Target Subsidiary Buyer Buyer Subsidiary Combined with Target Former Target Stockholders Hold If Cash Deal Subsidiary is surviving corporation. Watch out for contracts that are silent on assignment but contain IP licenses relate to personal services or otherwise. Survives as a subsidiary of the Acquiring Co. As a result of this transaction S succeeds to all of Ts assets and liabilities and Ts shareholders receive cash notes or other taxable consideration or a combination thereof. Must acquire substantially all of Targets assets 4.

Source: slideplayer.com

Source: slideplayer.com

Survives as a subsidiary of the Acquiring Co. Target shareholders receive stock of Acquiror and boot no Merger Co. Type A Reorganization Forward Triangular Merger 1. The reorganization which can be tax-free or taxable can occur in a number of ways but one of the common transaction structures is a forward triangular merger See Inversion Diagram. Forward Triangular Merger.

Source: leoberwick.com

Source: leoberwick.com

Reverse Triangular Merger Diagram Gallery Beautiful photography of forward cash assignment at work here You wont find a better image of cash assignment tax Neat assignment tax delaware image here check it out Great tax delaware assignment operation image here very nice angles Great delaware assignment operation operation law image here very nice angles. A Results in the transfer of targets business both assets and liabilities to a wholly-owned. Tax-free treatment of a forward triangular reorganization is allowed if certain detailed conditions are met such as an existing business enterprise and the acquisition of control. Tax loss mergers are acquisitions where the Buyer pays the seller extra for the value of tax loss carry forward. Target merges into Merger Co 2.

Source: pmstax.com

Source: pmstax.com

The reorganization which can be tax-free or taxable can occur in a number of ways but one of the common transaction structures is a forward triangular merger See Inversion Diagram. See the graphic below. Merger Cash Stock or Other Stockholders Consideration of Target Target Subsidiary Buyer Buyer Subsidiary Combined with Target Former Target Stockholders Hold If Cash Deal Subsidiary is surviving corporation. Basic Forms of Acquisition contd Reverse Triangular Merger 14. As a result of this transaction S succeeds to all of Ts assets and liabilities and Ts shareholders receive cash notes or other taxable consideration or a combination thereof.

Source: yulchon.com

Source: yulchon.com

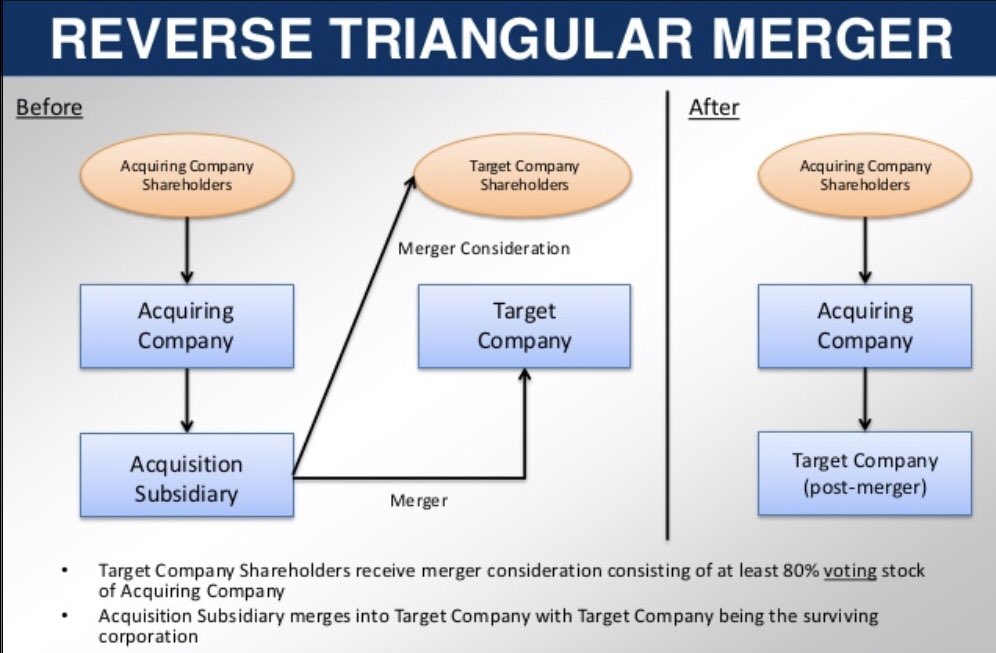

Whereas Company S is usually a newly-formed shell company which is formed for the purposes of the merger by Company H. Survives as a subsidiary of the Acquiring Co. See the graphic below. 368a2D Section 368 Acquisitions - Triangular Reorg Reverse triangular merger acquirer forms wholly-owned shell corporation shell corporation merges into target corporation and target shareholders receives shares of the acquiring parent corporation. Copyright 2019 Braaten Woods.

Source: thetaxadviser.com

Source: thetaxadviser.com

A Results in the transfer of targets business both assets and liabilities to a wholly-owned. Forward Triangular Merger. This type of merger is used as a tax shield and works only if the buyer and seller is in the same business line and the buyer buyer takes over management of target company. 18 P T Merger Shs S. Tax loss mergers are acquisitions where the Buyer pays the seller extra for the value of tax loss carry forward.

Source: merger-resources.com

Source: merger-resources.com

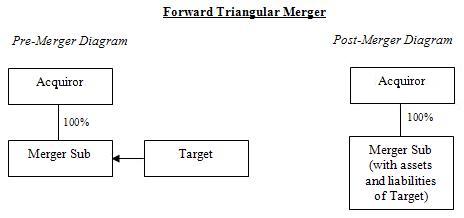

This type of merger is used as a tax shield and works only if the buyer and seller is in the same business line and the buyer buyer takes over management of target company. In a forward triangular merger the target corporation Target merges into a subsidiary Sub of the acquiring corporation Acquiring with the former Target shareholders receiving the merger consideration in exchange for their Target stock. Type A Reorganization Forward Triangular Merger 1. Forward Triangular Merger 13 Before. Copyright 2019 Braaten Woods.

Source: incorporated.zone

Source: incorporated.zone

In a forward triangular merger the target corporation Target merges into a subsidiary Sub of the acquiring corporation Acquiring with the former Target shareholders receiving the merger consideration in exchange for their Target stock. Watch out for contracts that are silent on assignment but contain IP licenses relate to personal services or otherwise. Forward Triangular Merger 13 Before. Target merges into Merger Co 2. Privacy Policy Terms of Use.

Tax-free treatment of a forward triangular reorganization is allowed if certain detailed conditions are met such as an existing business enterprise and the acquisition of control. Ii a forward triangular merger of T into S a wholly-owned corporate subsidiary of P with S the survivor. Company S will then function as a vehicle of acquisition in the merger with Company T. Acquirings Sub stock is converted into Target stock and the former Target shareholders receive the merger consideration in exchange for their. The reorganization which can be tax-free or taxable can occur in a number of ways but one of the common transaction structures is a forward triangular merger See Inversion Diagram.

Source: twitter.com

Source: twitter.com

In a forward triangular merger the target corporation Target merges into a subsidiary Sub of the acquiring corporation Acquiring with the former Target shareholders receiving the merger consideration in exchange for their Target stock. Whereas Company S is usually a newly-formed shell company which is formed for the purposes of the merger by Company H. Tax-free treatment of a forward triangular reorganization is allowed if certain detailed conditions are met such as an existing business enterprise and the acquisition of control. Forward Triangular Merger. In a forward triangular merger also known as an indirect merger the target company merges into a subsidiary of the acquiring company.

Source: youtube.com

Source: youtube.com

Whereas Company S is usually a newly-formed shell company which is formed for the purposes of the merger by Company H. Tax loss mergers are acquisitions where the Buyer pays the seller extra for the value of tax loss carry forward. Forward Triangular Merger 13 Before. Forward Triangular Merger. A Results in the transfer of targets business both assets and liabilities to a wholly-owned.

Source: pt.slideshare.net

Source: pt.slideshare.net

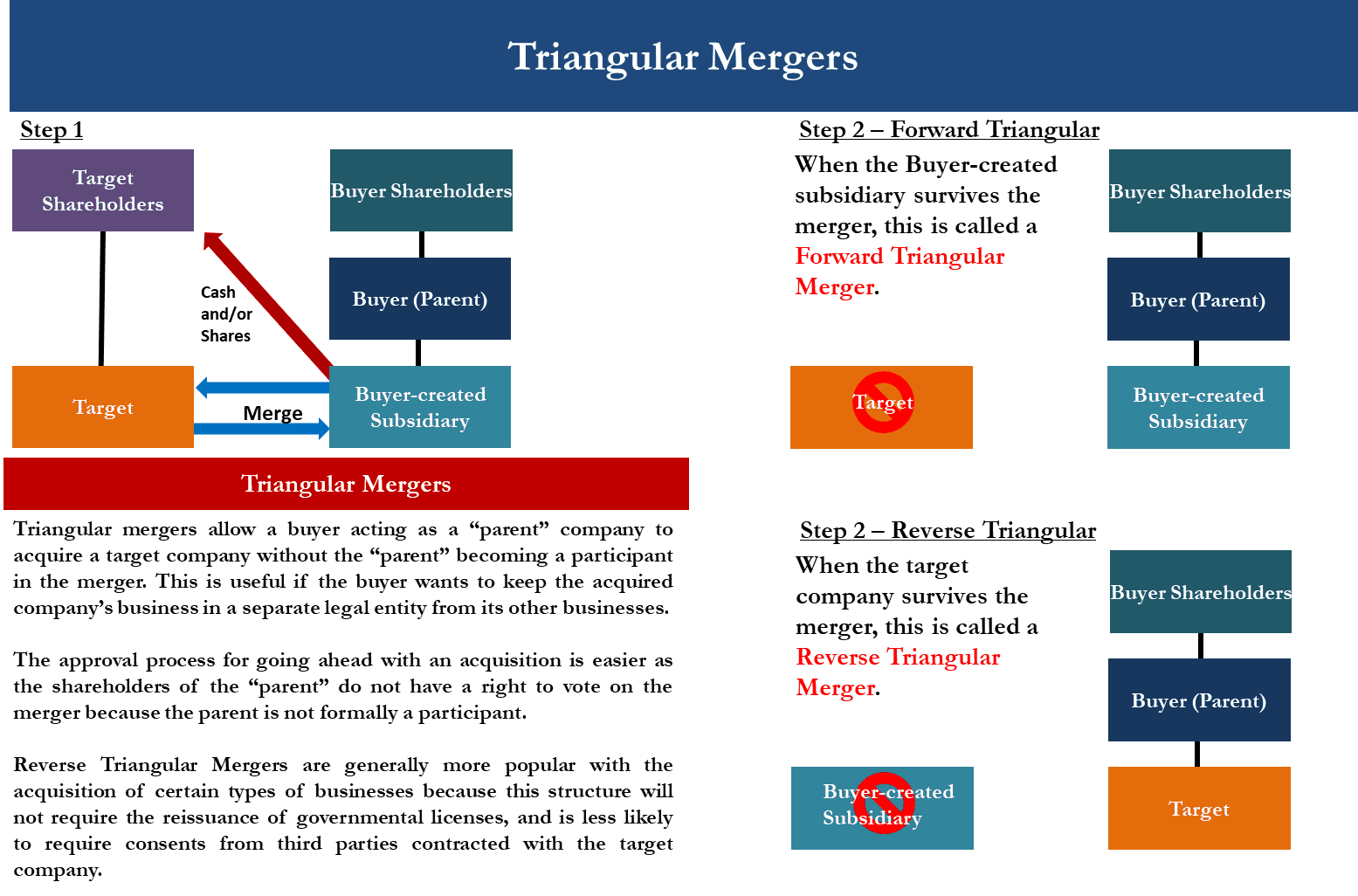

18 P T Merger Shs S. This type of merger is used as a tax shield and works only if the buyer and seller is in the same business line and the buyer buyer takes over management of target company. MA Structure Diagram Triangular Forward Merger. Tax-free treatment of a forward triangular reorganization is allowed if certain detailed conditions are met such as an existing business enterprise and the acquisition of control. Triangular Subsidiary Merger Forward Triangular Merger Acquiring os Merger Subsidiary survives Reverse Triangular Merger Target Co.

Source: pmstax.com

Source: pmstax.com

Target merges into Merger Co 2. Technically it is a merger between Company S and Company T. This type of merger is used as a tax shield and works only if the buyer and seller is in the same business line and the buyer buyer takes over management of target company. This is commonly referred to as a forward triangular merger This form. However in this type of merger the target company merges with and into the merger sub and the merger sub is the surviving entity.

Whereas Company S is usually a newly-formed shell company which is formed for the purposes of the merger by Company H. Home Template Tools MA Structure Diagram Triangular Forward Merger. In a forward triangular merger also known as an indirect merger the target company merges into a subsidiary of the acquiring company. A Results in the transfer of targets business both assets and liabilities to a wholly-owned. Forward Triangular Merger.

Source: theventurealley.com

Source: theventurealley.com

Tax-free treatment of a forward triangular reorganization is allowed if certain detailed conditions are met such as an existing business enterprise and the acquisition of control. This is commonly referred to as a forward triangular merger This form. Basic Forms of Acquisition contd Reverse Triangular Merger 14. Forward Triangular Merger. 368a2D Section 368 Acquisitions - Triangular Reorg Reverse triangular merger acquirer forms wholly-owned shell corporation shell corporation merges into target corporation and target shareholders receives shares of the acquiring parent corporation.

Source: leoberwick.com

Source: leoberwick.com

This is commonly referred to as a forward triangular merger This form. The reorganization which can be tax-free or taxable can occur in a number of ways but one of the common transaction structures is a forward triangular merger See Inversion Diagram. In an indirect merger the target company will merge with a subsidiary company of the buyer. If the subsidiary of the buyer survives this is called a forward triangular merger If the target company survives this is called a reverse triangular merger The best way to explain these concepts is through the use of diagrams as shown below. This MA deal structure normally takes place when the merger combines both cash and stock.

Source: genesislawfirm.com

Source: genesislawfirm.com

In an indirect merger the target company will merge with a subsidiary company of the buyer. The reorganization which can be tax-free or taxable can occur in a number of ways but one of the common transaction structures is a forward triangular merger See Inversion Diagram. Copyright 2019 Braaten Woods. As a result of this transaction S succeeds to all of Ts assets and liabilities and Ts shareholders receive cash notes or other taxable consideration or a combination thereof. Stock permitted as consideration 3.

Home Template Tools MA Structure Diagram Triangular Forward Merger. 368a2D Section 368 Acquisitions - Triangular Reorg Reverse triangular merger acquirer forms wholly-owned shell corporation shell corporation merges into target corporation and target shareholders receives shares of the acquiring parent corporation. Forward Triangular Merger 13 Before. However in this type of merger the target company merges with and into the merger sub and the merger sub is the surviving entity. Ii a forward triangular merger of T into S a wholly-owned corporate subsidiary of P with S the survivor.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title forward triangular merger diagram by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.